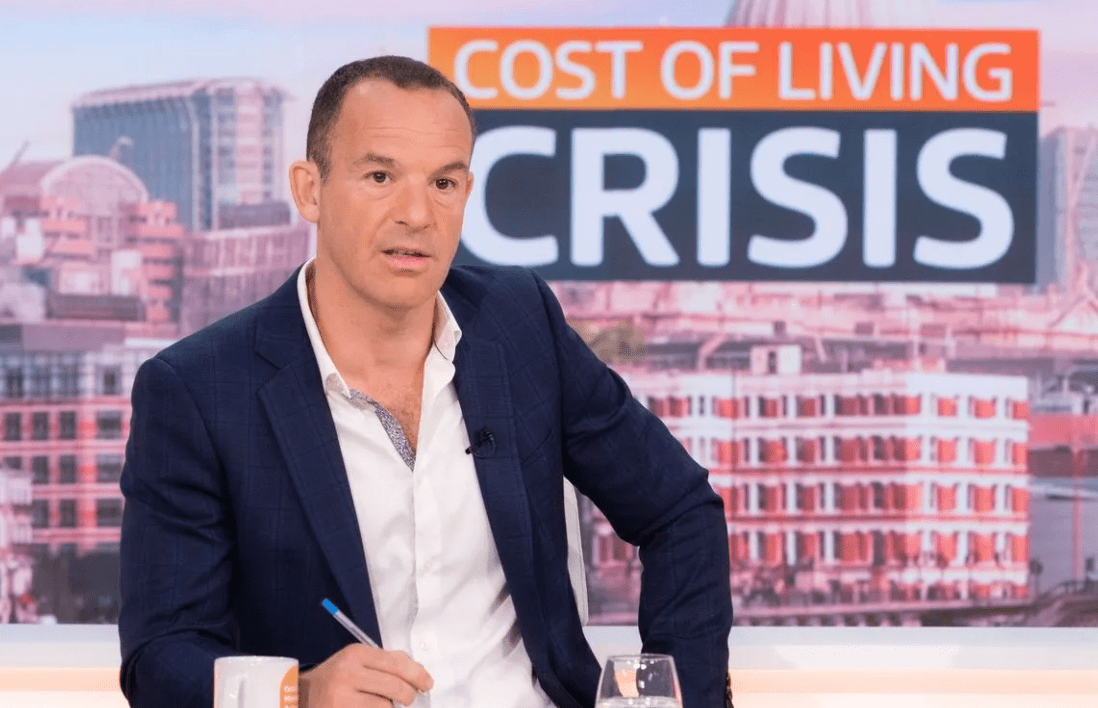

Money Saving Expert Martin Lewis is warning consumers who use credit cards about the dangers of using them as inflation rates are surging and the cost of our daily necessities is reaching record highs.

In the midst of the UK’s cost of living crisis, when prices are at an unaffordable level, families have turned to loans and credit cards.

Mortgage holders who have been hit hard by rising interest rates have also seen significant increases in monthly payments of several hundred pounds.

Martin Lewis, who is regarded as the financial savior of the British populace, has some advise for those who are in credit card and loan debt.

He only offers one message that is essential: “Pay off your credit card debts.”

People have started saving more money as a precaution, but Lewis advises that you should merely pay off your debt rather than starting a rainy day fund.

The basic answer is that paying interest on credit card debt for an entire year is much more expensive than earning interest in a savings account.

For instance, a £1000 credit card debt at a 22% interest rate costs £220 in interest over a year.

In addition, saving £1,000 at 3% earns £30 in interest annually, making you £190 richer for every year you pay off the loan!

However, there are certain exceptions to this guideline.

If you are locked into a bargain, your loan has no interest or your interest rate is lower than what interest on a savings account would yield.

Martin stated this about having a rainy day fund: “The idea of keeping some cash in a savings pot sounds comfortable, especially when traditional budgeting logic berates us to always have an emergency cash reserve.

“While it’s the proper goal, there’s a better option – pay off your debt with your money – for anyone with high-interest credit card debt, where you may borrow more without applying for a new product.

“However, don’t chop up your credit cards just yet; it’s crucial to maintain access to credit in case of a serious emergency.

And substantial implies precisely that—your roof collapses or you are unable to feed your children, not a new TV.

In front of Christmas, which the average Brit spends £904 on annually, he has reinforced this important advice.